"What is a ‘Leadfeeder’ and how will it actually help us make money?"

That's what your CFO will want to know when you suggest Leadfeeder Premium.

I get it — no one wants to drop money on another SaaS that ends at the bottom of the toolbox after the newness wears off.

Avoid throwing away your shot by going in armed with cold, hard facts.

By now, you understand how Leadfeeder's lead generation software works, but you need real numbers to make the case.

In this post, we’ll explore the financial benefits of Leadfeeder so you can show your boss that you’re a 10 — at least when it comes to business decisions.

To start, I'll show you how to use two calculators to get customized numbers for your business, then I'll share five ways Leadfeeder can help drive profits.

Note: Try Leadfeeder's 14-day free trial to kick your pipeline up a notch.

Leadfeeder profit calculator: break-even

This break-even calculator shows two things:

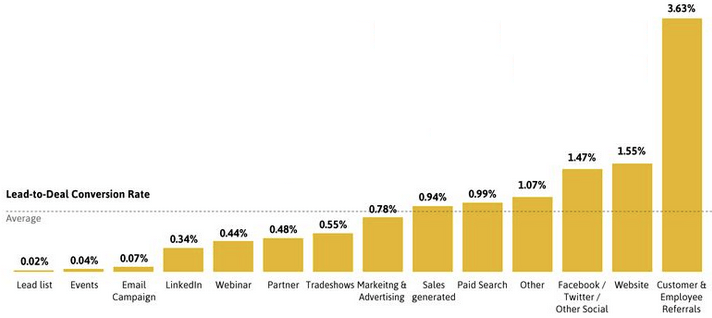

How many raw leads you need per month to reach a sales break-even point (lead-to-deal conversion rate of 1.55%), or:

How many deals you need to make per month (based on your average deal size).

How to use it:

Let’s use the average conversion percentage for website lead to deal to make some simple calculations in our incredibly useful break-even calculator.

Check your Leadfeeder monthly subscription fee (see the pricing page if you need help) and add it to the calculator.

Next, write down your average deal size.

Now press “Calculate”.

Easy, right?

Compare Leadfeeder's monthly cost to what most businesses charge for lead generation — usually between $200 and $300 per lead, depending on your industry. You could save hundreds — maybe even thousands — a month and get higher quality leads.

Leadfeeder profit calculator

Ready for some more complex math?

The first calculator showed you how many leads you needed per month; now we’re aiming for profit!

How to use it:

Like before, enter the monthly price you pay for Leadfeeder and your average deal size.

Now enter how many qualified leads you’ve earned with Leadfeeder during the last month. Check from the app if you can’t remember.

Then, enter the profits you typically earn per deal. If you sell something for $300 and it costs $100 to produce, then that’s a 67 percent profit.

Finally, enter your lead-to-deal conversion percentage —- or if you don’t know it, enter 1.55 (typical B2B website lead-to-deal conversion).

Click “calculate profits”.

5 ways Leadfeeder drives profits

Now, you've got those cold/hard/amazing numbers. But what other ways can Leadfeeder drive profits?

Increase website leads

Salesforces' B2B Sales Benchmarks: Lead to Opportunity Conversion Rate study found the average B2B sales conversion rate is 13 percent from lead to opportunity and 6 percent from opportunity to deal.

This means the average conversion rate from lead to deal is around 0.78 percent.

For every 130 “raw leads” your salespeople get, just one becomes a deal. As you can see in the graph below, conversion rates vary across channels, but 0.78 percent is the average.

For website leads, the conversion rate is higher, at 31.3 percent from lead to opportunity and 5% from opportunity to deal.

This gives an overall website conversion rate from lead to deal of around 1.55 percent – making your website the second best way to generate sales for your business.

Leadfeeder improves website lead generation, so you can increase that rate by focusing on companies who are interested in what you have to offer. For instance, you’ll avoid wasting time on someone who's just looking at job listings.

Increased hit rate

The average B2B conversion rate from cold calls to appointments are roughly 0.3 percent. Typically Leadfeeder customers report a 4x better hit rate compared to contacting cold leads (e.g. from a company database) by contacting companies who’ve shown an interest on their website.

Imagine how much this could increase if your salespeople aren’t blindly calling through “dumb” lead lists bought from some out-of-date company database.Time saved by marketing

The sales industry is becoming more intelligent and salespeople want more autonomy to qualify leads. SaaS tools like Leadfeeder put power in the hands of sales — and reduce time spent by marketing.

Our CRO Jaakko Paalanen said it best in this article on analytics-based sales.:

“It is important that sales and marketing work closely together, but it’s not efficient if they keep requiring each other’s time. Especially if there are tools that can automate the lead generation process from your website. When lead feeds can be created and monitored by salespeople alone, it will release time for marketing people to concentrate more on driving traffic and qualifying leads from other sources."

Reduced costs of retention

Once you’ve closed the deal, keep monetizing the existing relationship.

The probability of selling to an existing customer is 60-70 percent (according to this study), whereas the chances of selling to a new prospect are 5-20 percent.

Clearly, selling more to current customers is more valuable.

Tracking website visitors helps you understand what your existing customers are doing on your site, which puts you in a much better position to up-sell, cross-sell, and tailor offers to current customers.

Long-term benefits of Leadfeeder

The long-term benefits are more difficult to put in tangible numbers (and you’re proabably over my formulas (emoji)).

But, here are a few benefits of Leadfeeder you might not have noticed:

Track your competitors online and discover new competitors. We have a whole guide devoted to how to achieve this with Leadfeeder. Have a look.

Keep track of which investors are silently checking you out. This might be your upper management’s dream-come-true and the payback can be enormous.

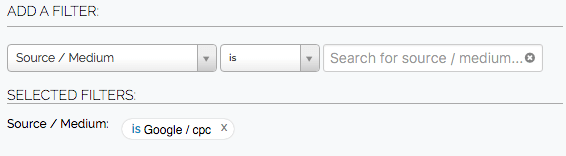

Measure how well SEM and other campaigns attract relevant leads. Want to quickly see how your paid ads and other marketing efforts generate relevant leads? Create a custom feed with filter “Source / Medium” = Google / cpc”.

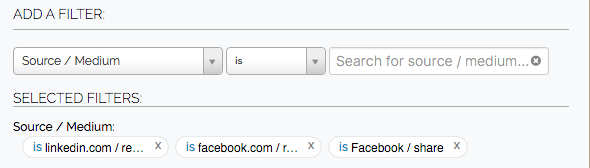

How about your social media channels? Are you creating awareness or do your social channels attract real B2B leads? Try creating the following filter in Leadfeeder:

Real-life examples of Leadfeeder ROI

If you’re not convinced by these awesomely simple calculators (perfect for answering those tough ROI questions from your boss), how about some real-life examples?

We asked some of our customers how Leadfeeder works for them when costs, deal sizes, and margins are considered.

Here’s one reply we got:

“Our lowest price point for a deal is £402. If we were able to convert at least one visitor at the small, medium, or large subscription price, then we would consider this a good return on investment. That said, this doesn’t take into account customer lifetime value, whereby the cost of acquiring a customer decreases should they renew for multiple years.”

Customer lifetime value can be difficult to evaluate, but if you’re in complex sales with high-value deals and long sales cycles, it’s truly invaluable.

Another example, one of our customers jotted down their LF stats over a single month:

Leadfeeder website leads: 120

Qualified and followed-up leads: 25

Opportunities (meetings): 8

Deals: 2

Here are some impressive stats from Programmatic B2B:

A recent campaign delivered 114 new healthcare leads and 155 insurance leads in less than 30 days. We were able to match those leads back to outbound efforts based on the URLs for account-based marketing (ABM) and a proprietary email domain parsing algorithm.

Conclusion

By now you’re probably feeling a bit bombarded by all the ways you can establish the true value of Leadfeeder for your company. But, hopefully, you've got the information you need to make the case for Leadfeeder.

Leadfeeder is not meant to be just another “SaaS toy” in your marketing stack. If you haven't tried Leadfeeder yet, sign up for a free account and start uncovering companies on your website today.

More leads, no forms.

Sounds too good to be true? It’s not. Identify companies already visiting your website and turn them into qualified leads to fuel your sales pipeline.

Show me how